This Unprecedented Real Estate Market

What is behind this latest surge? Are we in for another crash.

PALM COAST, FL – June 16, 2021 – Flagler County and Palm Coast were the poster children of the housing bubble 15 years ago, so it is easy to look at the area’s recent bullish housing market with a degree of trepidation. What is behind this latest surge? Are we in for another crash? Is this the new normal? It appears we are in a parallel universe where up is down and down is up.

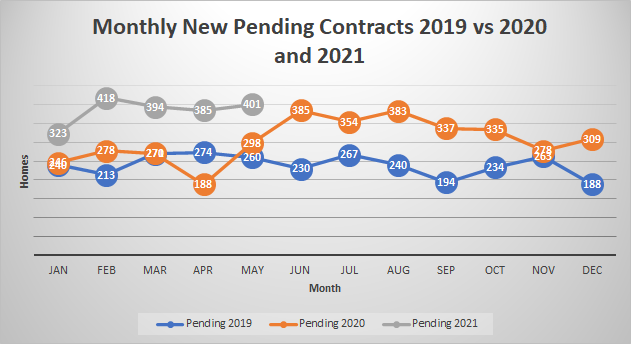

NEW PENDING SALES CONTRACTS FOR SINGLE-FAMILY HOMES

Where were we then?

The years between 2008 and 2012 marked the depth of Flagler County’s housing bust. Highlights, or lowlights, included:

- New foreclosures filings during 2008 and 2009 totaled 5,437, an average of 226.5 filings per month.

- During 2009, 2010, and 2011, more than half of all homes sold were either short sales or foreclosures.

- During both 2008 and 2009, sellers had reduced the median listing price by more than 14% before going to contract. In both 2010 and 2011, the reduction exceeded 10%.

- In 2009, sellers accepted a median selling price of only 80.9% of the original listing price.

- The median Days on Market (DOM) in 2009 peaked at 155. DOM measures the number of days between the listing date and the contract date.

- The number of Flagler County single-family homes listed for sale on MLS exceeded 2,000 during the recession but has ranged mostly between 800 and 1,000 for the last several years; never falling below 700.

- Only 628 single-family building permits were issued in Flagler County during the five years of 2008 – 2011, a yearly average of only 157.

Where are we now?

Today’s market is seemingly no better defined than the turgent market of 15 years ago, but a closer look reveals fundamental soundness that did not exist then. The numbers are nonetheless startling.

- New foreclosure filings over the past 12 months have averaged a mere 6 foreclosures.

- Distressed sales (foreclosures and short sales) have represented only 1.3% of home sales over the past 12 months.

- During March and April, sellers had raised the median listing price by 0.2% before going to contract at full listing price.

- In May, sellers raised the median listing price 1% before going to contract at full list price. All within a median DOM of only nine days.

- The number of Flagler County single-family homes listed for sale on MLS has hovered around 200 for months while the number of homes under contract has held near 700. Only in the past 10 days has the number of listings begun to climb to 260 today.

- During EACH of the first five months of 2021, the monthly number of single-family permits issued has exceeded the annual number issued in EACH of the full years 2008-2011.

- Less than one-half of one percent of our housing stock is available for sale on MLS. There are five realtors for each active home listing.

- For each home listed for sale, there are 2.75 homes under contract.

- Home sales dipped in early 2020 when pandemic restrictions kicked in but only for about 6 weeks during April and May. Since June 2020, the median selling price for Flagler County homes via MLS has been $260,000 or higher, exceeding for the first time, peak prices of the previous housing bubble. We are now teasing $300,000.

- The demand for and selling price of existing Palm Coast infill lots is exploding, signaling a demand for imminent new construction. Lot prices have more than doubled in the past 12 months to more than $50,000.

Another bubble?

The most amazing aspect of this upside-down reality is that Flagler County is not unique. Stories of scant inventories, multiple offers, bidding wars, and double-digit price increases can be heard from most parts of the country.

The homebuilding industry was decimated by the great recession. Many skilled construction workers found other careers. Coming into the 2020, there was a supply shortage of 2.5 million U.S. housing units, according to research by Freddie Mac.

Vacant homes remaining from the great recession were absorbed long ago, leaving new construction as the only remedy for the supply shortage. But builders face labor and construction supply shortages, coupled with the extended timeframe to find, zone, permit, and develop land for new projects. These trends are not likely to change soon, if ever.

There are fundamental differences between the last bubble and the current market. The 2005-2006 bubble was driven by speculator buyers and easy credit. Today’s speculators are chasing virtual currency and fringe stocks rather than real estate. While mortgage rates are at historic lows today, lending standards are strict. Today’s buyers are not only creditworthy but also plan to hold onto their purchases, not flip them.

Migration to Florida, particularly from high-tax states that experienced high Covid-19 hospitalization and death rates as well as riots and rising crime rates has accelerated. Maslow’s hierarchy of needs rests upon the most basic needs: food, water, warmth, rest, security, and safety. A recent analysis of address change notifications to the USPS indicates that change of address filings in Flagler County are about evenly split between those who moved within the county, those who moved from another county in Florida, and those who moved from another state or internationally.

The local economy was driven 15 years ago by the construction industry. Today, Flagler’s economy is stronger and diversifying. The shuttered Sea Ray plant is reopening under the Boston Whaler banner. Our economy is shifting its emphasis towards healthcare. Town Center will soon see UNF’s MedNex campus and Jacksonville University’s satellite advanced degree healthcare campus. Two new hospitals are planned in the city. Healthcare is a well-paying growth industry and is less subject to economic turbulence.

Flagler County has been rediscovered. Large regional and national builders realize that this is the last affordable option on the entire east coast. Flagler schools are excellent. The county’s crime rate is low. There are plenty of options for outdoors activities, miles of beach and Intracoastal Waterway access, and the climate is wonderful.

The double digit increases in home prices are not sustainable in the long term. They will ultimately begin to level out, but the forces behind today’s strong housing market are powerful and enduring. There should be no bubble to burst this time.

Leave a Reply

Want to join the discussion?Feel free to contribute!